WAGYU Tokenomics + TGE Timeline

To accompany the decentralized protocol is the WAGYU token, the governance and utility token of the Tenderize ecosystem. We believe it features value alignment unrivaled in the web3 ecosystem.

Gm Chefs,

Tenderize Labs has completed the development of Tenderize v2, and its code has been shipped off to Halborn for security audits. This means we are just a few weeks away from a totally permissionless liquid staking solution for stakers of MATIC, GRT, and LPT, with more tokens such as ETH to follow afterward.

To accompany the decentralized protocol is the WAGYU token, the governance and utility token of the Tenderize ecosystem. We believe it features value alignment unrivaled in the web3 ecosystem.

Purpose

The WAGYU token is a multi-faceted asset that aims to align incentives between all stakeholders of the Tenderize ecosystem. Its value is directly tied to the growth and adoption of Tenderize v2. WAGYU is used to incentivize various behaviors designed to improve liquidity of the system by continuously capitalizing it.

Tenderize Labs designed Tenderize v2 to be community owned and operated. The core protocol is automated; once the flywheel starts, it can’t be shut off. The protocol is designed with a governance-minimized approach, increasing the security of funds and reducing reliance on token voting. However, some components of the ecosystem, such as TenderSwap and BeefBank, feature virtual levers that can be adjusted. To ensure no one group is in control of these levers nor the protocol’s treasury, the WAGYU token exists to distribute decision-making power.

The WAGYU token plays additional roles in the ecosystem, which fuels demand for the token. For example, an upcoming product launched by Tenderize Labs is a retail focused product: an index of Tenderize’s validator specific LST tokens. The weight of each LST that the index is composed of is curated by staking WAGYU. The amount of WAGYU staked toward each LST will determine that LST’s allocation within the index. By staking and curating the index, these users earn a share of the revenue generated by the index.

Tokenomics

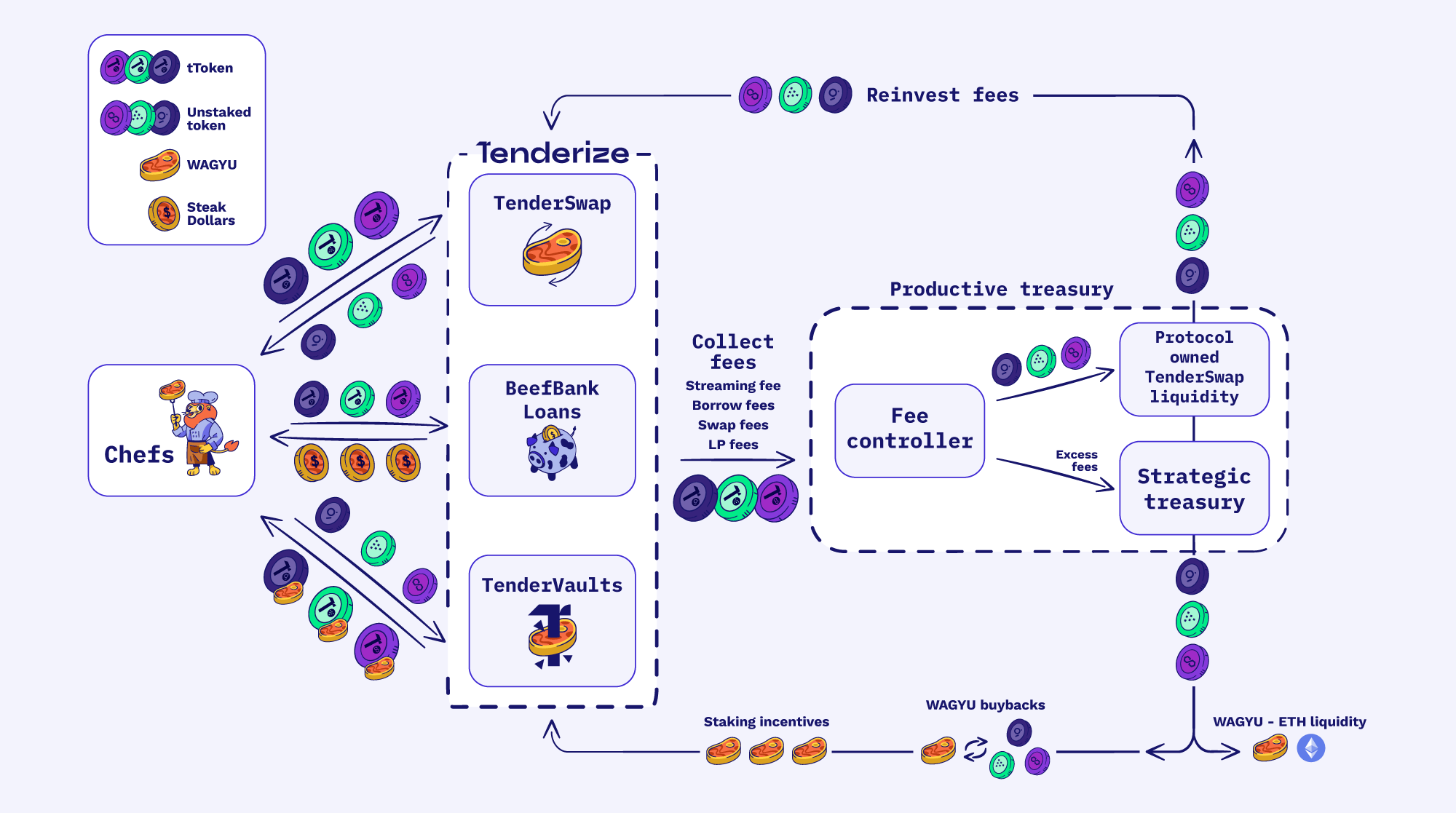

WAGYU’s value is inherently tied to the value of assets within the Tenderize ecosystem. The tokenomics of WAGYU are designed to retain and constantly reinvest protocol revenue to grow capital within the Tenderize ecosystem. By reinvesting fees collected, users get a significantly improved experience thanks to deep liquidity and more value accrual to WAGYU itself. This makes sure that all stakeholders are aligned to guarantee optimal performance of the system.

After launch, WAGYU will be redeemable against its treasury under certain conditions, ensuring a “floor price” equal to the treasury value per WAGYU in circulation. The treasury is yield-bearing and constantly growing; the market can determine a free-floating rate on top of the floor price based on market demand for WAGYU yield and utility.

There is no way to determine the future value of WAGYU, but one can assume the value is the net asset value of assets owned by Tenderize v2 + a premium to account for future revenues generated by Tenderize v2 and its protocol-owned assets.

The treasury can also offer WAGYU to attract treasury assets. This will occur at genesis to attract TenderSwap liquidity and can be utilized in the future when protocol revenue isn’t sufficient to provide the needed TenderSwap liquidity.

Instead of distributing revenue to WAGYU stakers, as is a common practice in DeFi, it is retained within the protocol or used as an incentive to attract capital. This produces an effect where the amount of assets the Tenderize protocol owns is constantly growing. The growing number of assets can result in a higher net asset value controlled by Tenderize v2 and the WAGYU token. This creates a new, unstoppable flywheel in DeFi - backing WAGYU with the protocol owned treasury and future earnings generated by protocol users.

Protocol Revenue

Instead of directly distributing protocol revenue to stakers of the governance token, revenue is constantly used to recapitalize the ecosystem where it’s most needed. Primarily, revenue will be allocated to protocol owned liquidity for TenderSwap. Excess revenue can be allocated to on-chain liquidity pools for the supported assets, staked within Tenderize itself or used to buyback WAGYU to fund user incentives.

The protocol generates revenue in multiple ways:

- TenderSwap fee: Applied to swaps from tToken to the unstaked token

- TenderVault streaming fee: Applied to rewards accrued by tTokens

- BeefBank fees: Applied when borrowing stables and repaying a loan

Once TenderSwap POL is sufficient, excess revenue buys back WAGYU from the open market. This is distributed back to users by offering the token as an incentive for users to provide capital where growth is needed most. Using revenue to fund incentives without inflating the total supply is key to constantly attracting new capital without diminishing the value of WAGYU.

Productive Treasury

The productive treasury is a key component of the WAGYU tokenomics. It represents all assets owned and controlled by the protocol. The primary goal of the treasury is to ensure permanently growing liquidity in the Tenderize ecosystem. The lions share of revenue is allocated as protocol-owned liquidity for TenderSwap, where it is earning swap fees and reducing slippage for TenderSwap users.

When TenderSwap is adequately capitalized, revenue collected by the protocol is considered excess revenue. Determined by the fee controller, excess revenue can be strategically allocated throughout the Tenderize ecosystem to improve user experience and further treasury growth.

Since the treasury is yield-bearing, it will continuously grow over time, positively affecting the future revenues which are captured by Tenderize v2 and governed by WAGYU.

Distribution

There will be a hard cap of 1B total WAGYU issued. These tokens have varying purposes within the Tenderize ecosystem and warrant varying vesting periods mentioned below.

Release Schedule

The WAGYU will be distributed over the course of 3 years, at which time the protocol should be fully matured with voting power distributed across a diverse community of stakeholders.

Token Generation Event

October - Mainnet Launch - WAGYU IOUs start

Tenderize v2 will go live on Ethereum L1 and Arbitrum L2. MATIC deposits will occur on Ethereum L1, with LPT and GRT happening on Arbitrum L2. Users can begin accruing IOUs for future WAGYU rewards.

- Tenderize v1 stakers receive an airdrop funded with 0.5% of total WAGYU supply.

- Tenderize v2 staking incentives begin streaming.

November - TenderSwap Bonding Period

To bootstrap protocol owned liquidity, users will have the opportunity to reserve a WAGYU chicken bond. Users deposit MATIC, LPT or GRT and receive a locked allocation of WAGYU. At maturity, the user can chicken in - keeping their WAGYU - or chicken out - redeeming the MATIC, LPT or GRT, sacrificing WAGYU. More details coming in future blogs.

- User buys WAGYU with MATIC, LPT or GRT

- MATIC, LPT GRT permanently providing Tenderswap liquidity

- WAGYU becomes liquid after a pre-specific time period after TGE

- Discount and strike price will reflex the vesting period

December - WAGYU Generation Event

WAGYU Protocol Owned Liquidity Sale

- User buys WAGYU with ETH

- ETH gets paired with Foundation WAGYU to make WAGYU-ETH market

Genesis Airdrop (December)

Users will receive the Genesis airdrop two months after the mainnet deployment of v2. The exact criteria to qualify will remain confidential.

- V2 Interactions: 3.5% total supply (12 mo linear)

If you have any questions at all, hop into our Discord today or join us on Wednesday, September 6th at 10a ET / 2p UTC.